Restaurant Brands International (RBI) has announced two significant deals aimed at boosting its presence in China. The Toronto-based company plans to invest up to $45 million in a market it views as highly promising.

RBI, the parent company of Tim Hortons, Burger King” data-wpil-keyword-link=”linked”>Burger King, Popeyes Louisiana Kitchen, and Firehouse Subs, is set to acquire Popeyes China from Tims China, which currently operates Tim Hortons franchises in the country. The acquisition, valued at $15 million, includes 14 Popeyes restaurants already operating in Shanghai since their launch in August 2023. RBI intends to implement a “master franchisee” model for Popeyes in China, similar to its strategy in other countries.

In addition to the acquisition, RBI will partner with Cartesian Capital to invest up to $50 million in Tims China through three-year convertible notes, allowing the company to receive up to $30 million.

Long-Term Market Potential

RBI’s Asia Pacific President, Rafael Odorizzi, emphasized the growth potential in China for both the Popeyes and Tim Hortons brands. “China is one of the most compelling long-term market opportunities for both our Popeyes and Tim Hortons brands. Popeyes China is off to a strong start and we are excited to unlock its development potential,” he said.

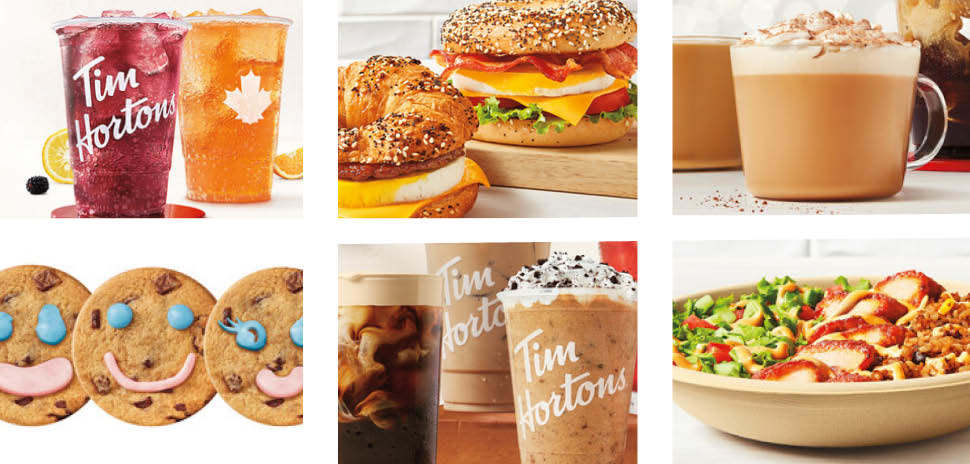

This investment will enable Tims China to focus on quality restaurant development and providing high-quality coffee and food offerings to Chinese consumers. Additionally, RBI will gain the right to appoint two directors to the Board of Tims China, increasing its equity ownership in the business to up to 18%.

Cautious Optimism Amid Economic Challenges

Just five months ago, RBI had expressed caution regarding its expansion in China, citing uncertainties in its fourth-quarter financial results. At that time, the company had projected net restaurant growth to climb by at least five percent between 2023 and 2024. However, the outlook was revised due to economic challenges, including a drop in consumer spending and an economic slowdown in China.

RBI CEO Joshua Kobza highlighted the need to adjust expectations. “A key factor to delivering this level of growth was our expectation that our development in China would accelerate in 2024 off of 2023 levels,” Kobza said in February. “We now believe that outlook is less certain and have updated our outlook to reflect a lower level of net unit additions in China this year.”

Despite these challenges, RBI remains optimistic about the Chinese market. The company expects consolidated global net restaurant growth to be in the mid-4% range this year, with acceleration anticipated in 2025.

Commitment to Long-Term Growth

RBI’s commitment to the Chinese market underscores its belief in the region’s potential. Kobza stated, “We have a strong belief in China as an attractive growth market for our brands. Given the incredible geographic scope and population of the market, success there requires a serious long-term capital commitment from our partners, a long-term time horizon and a commitment to grow the brand in the face of tough competition.”

With these strategic investments and partnerships, RBI is positioning itself for sustained growth in one of the world’s most dynamic markets.